Security

Let’s work together to keep your accounts and information safe.

Below is some general security information, Mobile and Online Security Best Practices and Prevention Best Practices to keep you safe.

You should never send your personal information to us in an email AND we’ll never email or call you to ask you for your personal information as a requirement for getting additional security to manage your accounts online.

To report suspicious email or other scams please call us at 513-734-4445.

We use a variety of technologies to help ensure our products and services are secure and are always looking for ways to improve them.

You should protect yourself while conducting business online.

What is Identity Theft and What Can You Do to Prevent It?

Identity (ID) theft is a crime where a thief steals your personal information, such as your full name or social security number, to commit fraud. The identity thief can use your information to fraudulently apply for credit, file taxes, or get medical services. These acts can damage your credit status, and cost you time and money to restore your good name. You may not know that you are the victim of ID theft until you experience a financial consequence (mystery bills, credit collections, denied loans) down the road from actions that the thief has taken with your stolen identity.

Mobile & Online Banking Security Tips:

- Lock and secure your mobile device with a PIN or password.

- Create strong passwords - not easy to guess - using a mixture of letters, numbers, and special characters. Change your passwords often.

- Do not store your user names or passwords in plain text on your phone.

- Using public WiFi access is not secure and isn't recommended while mobile banking.

- Be cautious in public of others viewing your mobile device and key strokes.

- If you notice suspicious activity in your accounts, report it immediately.

- Don’t open emails from unknown sources and don't open any attachments they may contain. They could contain a virus that is set to activate upon opening. When in doubt, delete the message without opening it.

|

|

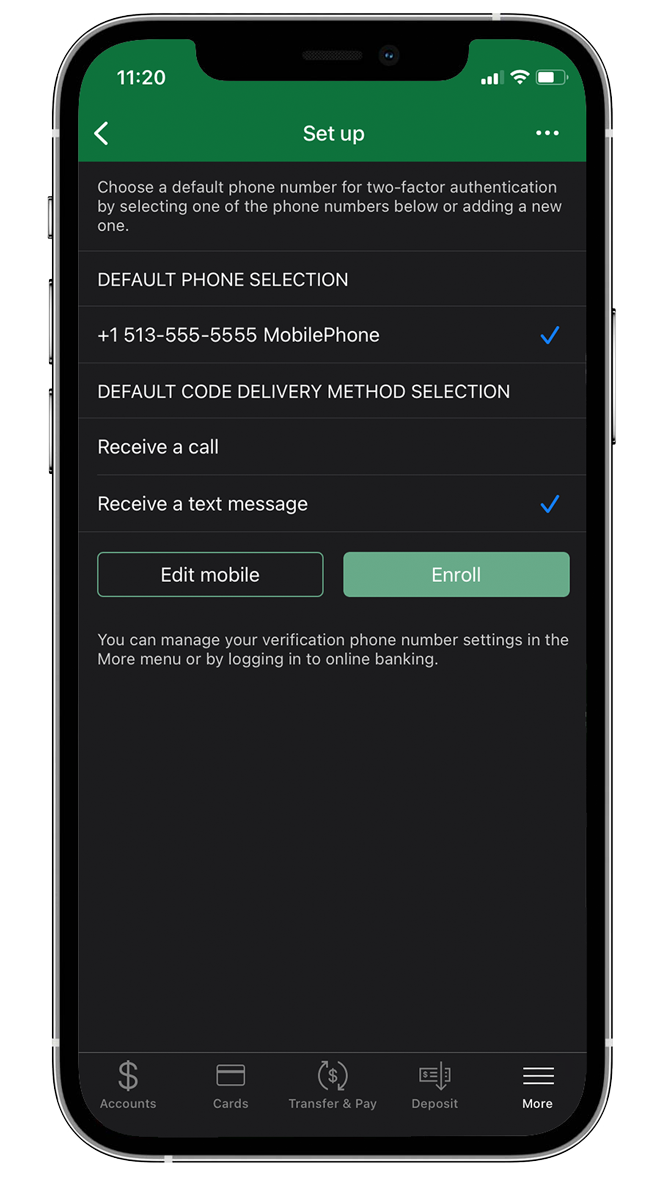

Your CSB Online Banking Is Now Secured with Two-Factor Authentication

A strong password can help to keep your accounts and data safe, but in the event of a data breach, you'll want something more secure. Two-factor authentication adds another layer of security to your personal information. More account protection = More peace of mind.

When you first set up your CSB Online Banking account, you'll be prompted to verify your account with two-factor authentication. This is a quick and simple process to verify your identity by providing a code you receive by text or phone call to a number you provide.

After authenticating on any device you regularly use (such as your laptop or cell phone), you won't be prompted to authenticate with a code as frequently. In most cases, you may only receive this request to log in with two-factor authentication again if you're trying to check your account on a different device, or if you're traveling.

If you have any other questions, or if you have any trouble receiving your authentication code in the future, don't hesitate to give us a call to help you out.

|

Lost or Stolen Debit & ATM Cards

In the event of a lost or stolen Community Savings Bank Debit/ATM Card, or any unauthorized use of your card or PIN number, contact us immediately at: (513) 734-4445. For help after hours please call: 800-554-8969.

|